Is Axing Negative Gearing the Fix for Australia’s Housing Crisis?

Reading Time: 4 minutes

The potential removal of negative gearing will mark a significant change in Australia's property investment landscape. If you're a landlord, tenant, or prospective homebuyer, understanding how this shift could impact the housing market is critical. Let's break down what negative gearing is, who will be affected, and what history and international experience tell us about the likely consequences.

What is Negative Gearing?

Negative gearing occurs when the cost of owning an investment property, such as mortgage interest, maintenance, and other expenses, exceeds the rental income. The shortfall, or loss, can be deducted from the investor's taxable income, lowering their tax liability. This has long made property investment more attractive, particularly in areas where rental income is lower relative to property values.

Negative Gearing Explained

Who Will It Impact?

The removal of negative gearing will have broad-reaching implications, particularly for Australian landlords. Based on Australian Tax Office (ATO) data from 2021-22, nearly 2.3 million Australians owned investment properties, representing around 20% of the country’s 11.4 million taxpayers. Of these landlords, 71% own just one investment property, and approximately 950,000 landlords reported losses that were offset by negative gearing benefits.

This means that a substantial number of "mum and dad" investors rely on negative gearing to make property ownership viable. The removal of this tax benefit could particularly affect those with limited cash flow, making property investment less attractive and less financially feasible.

Lessons from New Zealand

To predict the potential outcomes of negative gearing removal in Australia, it's helpful to look at New Zealand, which made a similar policy change in March 2021. Landlords lost the ability to claim interest paid on investment properties, and this change coincided with a sharp rise in the official cash rate.

The effects were noticeable. Prior to the removal of negative gearing, rent prices in New Zealand had been rising at an average rate of 4.7% per year. After the policy change, the rate of rent increases jumped to 6.8% annually. Investor activity slowed only slightly, while first-time homebuyer activity increased somewhat.

Source: ABC News | Prepared by Premier Buyers

However, the reduction in investor activity resulted in a shrinking rental supply, which, coupled with increasing demand, led to higher competition among tenants and rising rents. If the same happens in Australia, renters could see steeper rental increases as fewer investment properties are available.

The 1980s Experiment in Australia

Australia has already experienced the impact of negative gearing removal in the 1980s. The government temporarily abolished the policy, leading to dramatic rent increases in cities like Sydney and Perth. The rental crisis that ensued forced the government to reinstate negative gearing after only a few years.

This historical example shows that removing negative gearing doesn’t necessarily make housing more affordable. Instead, it simply shifts the burden to renters, who end up paying higher rents due to decreased investment in rental properties.

What Can You Expect?

If negative gearing is removed, several key changes are likely:

Decline in Property Investment: The immediate effect will likely be a reduction in property investment, especially for new investors. The removal of tax benefits will make property ownership less attractive, particularly for those who rely on negative gearing to make their investment viable.

Investors Exiting the Market: Some current investors, especially those with tight cash flows, may decide to sell their properties, leading to a short-term increase in property listings. While this could create a temporary dip in property prices, the long-term impact might be different.

Rising Rents: Australia's rental market is already under pressure, with vacancy rates below 1.5% in many regions. As investors exit the market and rental property supply shrinks, landlords will likely increase rents to offset the loss of tax benefits, further squeezing tenants.

Marginal Increase in Home Ownership: A reduction in investor demand could create more opportunities for first-time homebuyers, but this impact is expected to be marginal. The underlying issue of housing affordability will remain, especially if the new supply doesn't meet demand.

Construction Slowdown and Supply Issues: When investor demand slows, so does housing construction. Given Australia’s existing housing supply shortage, particularly in the rental market, this could exacerbate the housing crisis. Fewer new homes would be built, leading to heightened competition among tenants, especially lower-income renters who are most dependent on rental properties.

A Long-Term Solution Requires More Than Negative Gearing Changes

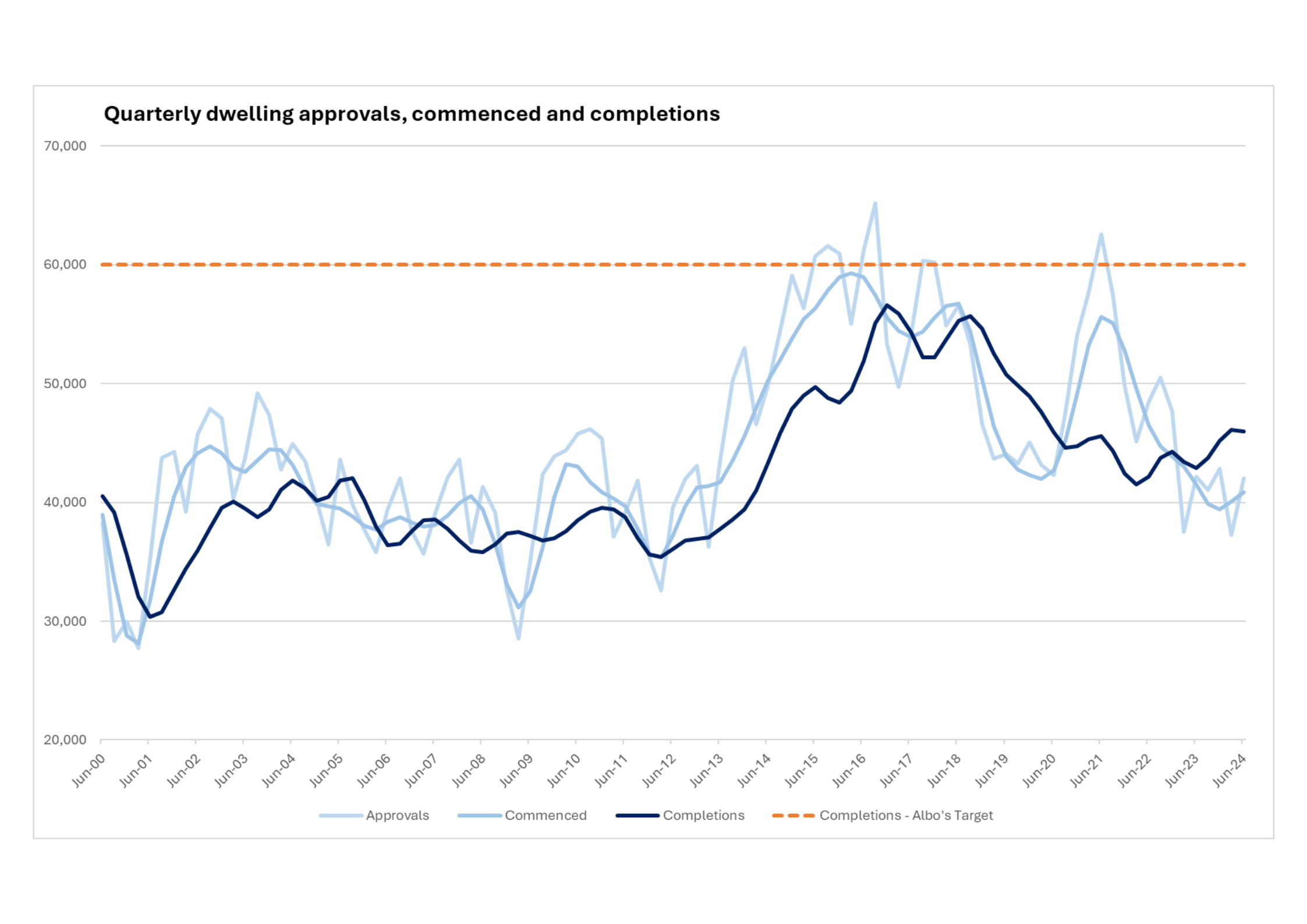

If you're hoping that the removal of negative gearing will solve Australia’s housing crisis, you may be disappointed. The real issue lies in a chronic shortage of housing supply. Australia needs approximately 60,000 new homes every three months to meet demand, but construction rates consistently fall short of this target. While a short-term price correction may occur, it is unlikely to resolve the underlying issue if the housing supply remains constrained.

Source: ABS | Prepared by Premier Buyers

Instead of discouraging investment by removing negative gearing, policymakers should focus on boosting housing construction, particularly affordable rental housing. Addressing the root causes of the supply shortage will do more to ease the housing crisis than removing tax benefits for investors.

Final Thoughts

The removal of negative gearing is poised to bring significant changes to Australia’s property market. While it may cool investor activity in the short term, the broader effects could be higher rents and an exacerbation of the housing supply crisis. For renters, landlords, and homebuyers, the road ahead could be challenging.

The solution to Australia’s housing woes doesn’t lie in removing tax incentives for investors but in encouraging investment in a way that increases housing supply. Without sufficient new homes being built, especially affordable rentals, the housing crisis will continue to deepen.

We’re here to help

Interested? If you're like many property investors, you're probably wondering what's the right thing to do at present. Should you buy, should you sell, or should you just wait? Let us help you buy your next investment-grade property. Book an obligation-free consultation today.

Other helpful articles for your property journey that a buyer’s agent can assist you

Should You Invest in an Investment Property in 2024?

Most Common Mistakes Investors Make When Buying Property

Top 5 tips for selecting the right suburb to invest in

Guide to finding the right investment property

Buying an investment property through SMSF

Essential Tips for New Investors After Purchasing a Property

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any individual objectives, financial situation or needs. Before acting on this information, Premier Buyers recommends that you consider whether it is appropriate for your circumstances and engage qualified professionals.